Tracking Changes in Xero

Hunting down historical changes in Xero has always been a challenge. Now there is a better way...

By Rich Nicolson • October 15, 2018

A common problem

Accountants are often required to report on the financial accounts of a business on a regular basis - monthly, quarterly or annually - to a number of interested parties such as the tax authorities or the business’s board of directors.

When these numbers have been reported, it is embarrassing and potentially harmful for these numbers to be found to be incorrect or altered in some way further down the line, especially if the board has used them to make business decisions.

However, a disturbingly common, frustrating problem that accountants are faced with is that these numbers are unknowingly or mistakenly changed after the period has been closed and reported upon.

"I would be surprised if you came across an accountant that hadn't had this issue" - Craig Bailey, FD Works

Xero has a concept of Locked Periods and restricts changes within these periods to users with Advisor permissions, but these are not always kept up to date and even if they are it is still relatively easy for an advisor to make a change (mistakenly or miscommunicated) in this instance.

Something has changed, but where?

Once an accountant identifies that their numbers for a previous period have changed, they generally have two options:

- Option 1: Find the transaction(s) that caused the change, and move them to the current period

- Option 2: Adjust the current numbers to account for the variance, in this month and in all proceeding months until year end. This option is only possible if the accounts have not already been filed with the authorities.

Most accountants using Xero have to spend several hours finding a variance by pouring through the accounts, starting at a high level and digging progressively deeper in areas that look incorrect until they have found the problem transaction or transactions. The larger your business is, the longer this process takes.

The variance may not be apparent immediately, and it may be some time before it is spotted and an investigation launched. Variances needing investigation at year-end take longer to find due to the cumulative build-up of transactions.

Xero have created a History and Notes Activity Report and an Assurance Dashboard Report to try and address this issue, neither of which appear to be satisfactory for accountants based on these forum discussions 1, 2, 3...

There has to be a better way

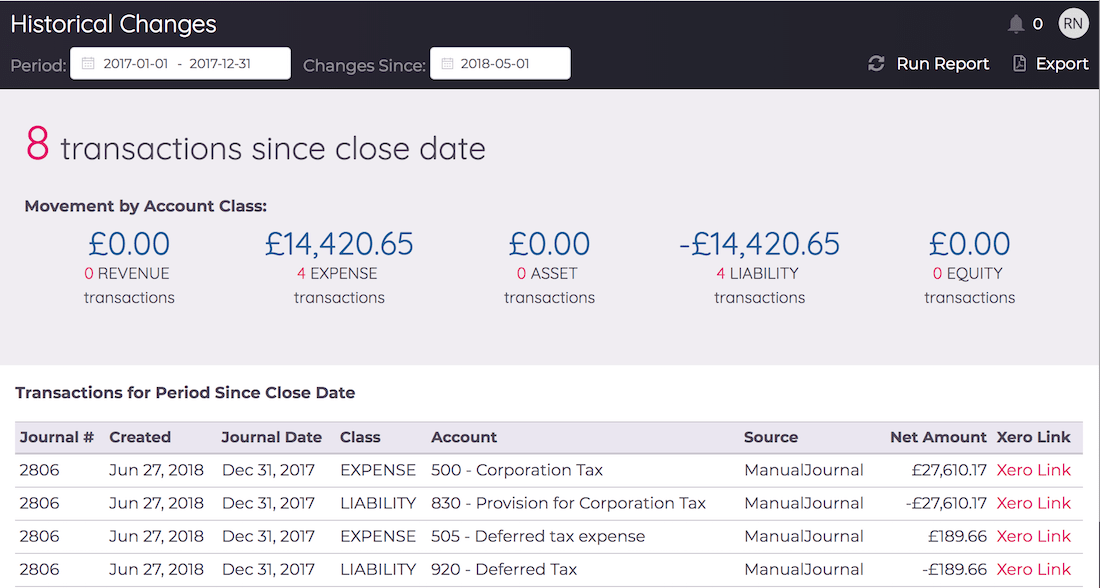

And now there is! Within Xavier, we have built an insight that allows you to see if anything has changed within a historical period after the reporting close date, and if so, exactly what has changed and when. Simply set the period start and end dates and the reporting close date (the date you stopped making changes and produced your reports) and click Run Report. Within a few seconds Xavier will produce your results.

You can jump straight to the offending transaction(s) in Xero from the results. And, in case you need to show someone else where it all went wrong, you can always export the results to PDF.

Feel free to jump in and give it a try, and let us know how you get on!

~ Rich